Alpha formula finance

The funds alpha is calculated as. Alpha is a risk ratio that measures how well a security such as a mutual.

Alpha Learn How To Calculate And Use Alpha In Investing

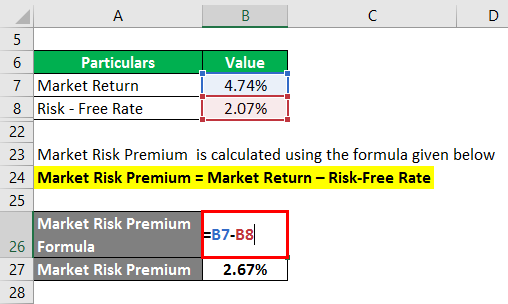

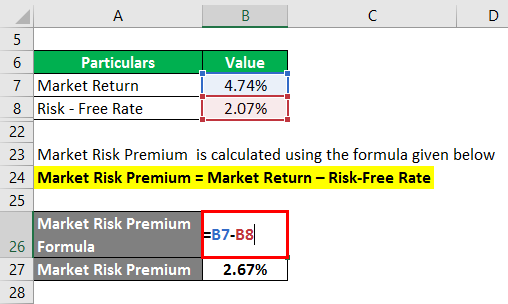

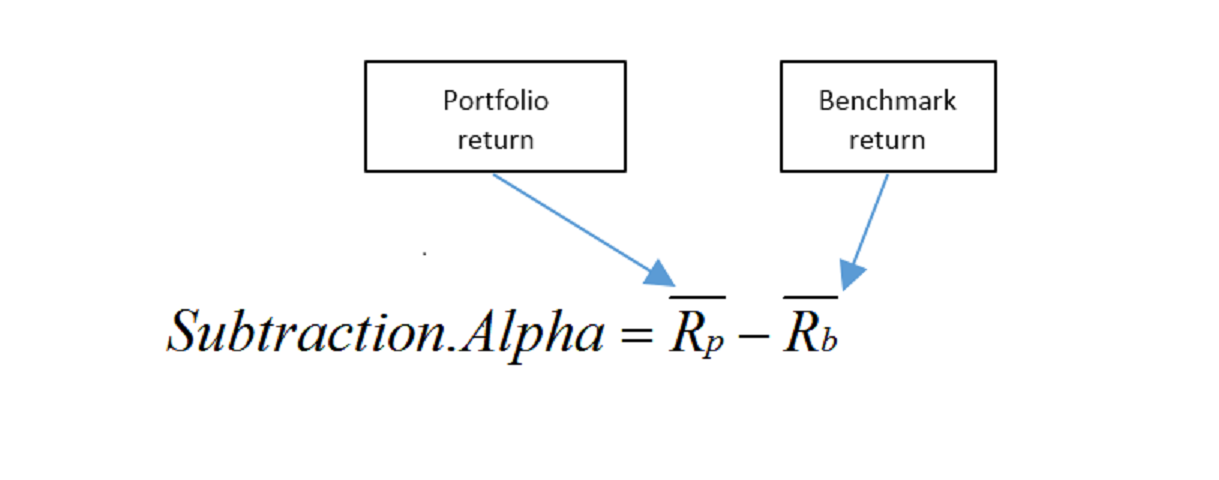

Alpha Formula Alpha Portfolio Return Benchmark Return Alternatively the difference between the expected return from the capital asset pricing model CAPM ie.

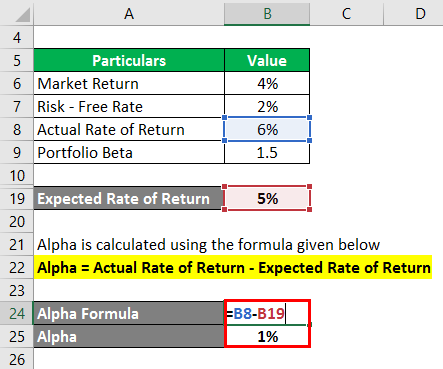

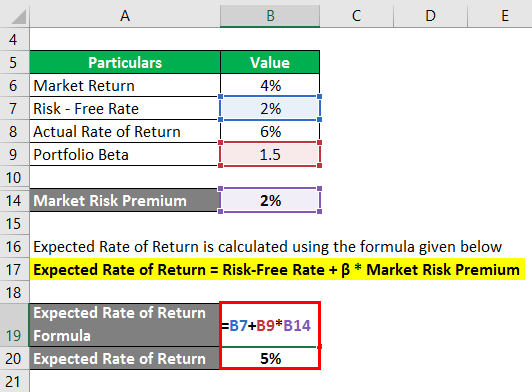

. Mathematically speaking Alpha is the rate of return that exceeds a financial expectation. We will use the CAPM formula as an example to illustrate how Alpha works. α Rp Rf Rm Rf β Where.

Ad Create Unique Portfolios for Your Clients Starting with BlackRock Models. First let us look at the Beta of the. Ad Get Personalized Advice Tailored To Your Financial Picture.

Alpha 15 - 3 12 x 12 - 3 15 - 138. It can help tell you. Get Help Achieving Financial Goals From An Advisor Held To A Fiduciary Standard.

Alpha is calculated using a simple formula. Ad SPX Index options begin trading at 3 am. To compute the moving average we first need to find the corresponding alpha which is given by the formula below.

Do your ETF options do that. Unique Tools to Help You Invest Your Way. In finance an investment with high alpha is one that has exceeded its benchmark in terms of returns.

A simple formula is used to calculate the alpha coefficient which takes into account the Sharpe Ratio Beta of the investment. Rp Realized return of portfolio Rm Market return Rf the risk-free rate β the assets beta What Does Alpha Measure. Find A Registered Advisor.

Alpha α is a financial metric that investors and portfolio managers can use to compare the performance of an investment to a related benchmark. N number of days for which the n-day moving average is. Jensens Alpha Expected Portfolio Return Risk Free Rate Beta of the Portfolio Expected Market Return Risk Free Rate.

The formula for alpha is. Alpha r - R f - beta R m - R f r the securitys or portfolios return R f the risk-free rate of return beta systemic risk of a portfolio R m the market. Ad Your Investments Done Your Way.

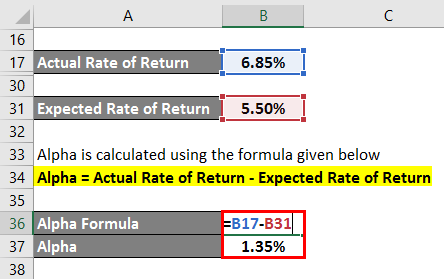

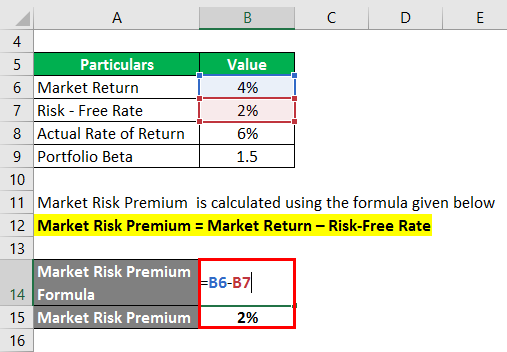

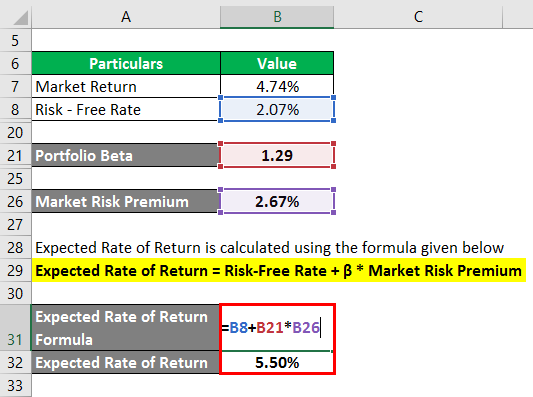

The beta of the fund versus that same index is 12 and the risk-free rate is 3. Alpha is calculated using the formula given below Alpha Actual Rate of Return Expected Rate of Return Alpha 685 550 Alpha 135 Advantages of Alpha in.

Alpha Formula Calculator Examples With Excel Template

Alpha Formula Calculator Examples With Excel Template

What Is Alpha In Finance Definition Formula Examples Thestreet

Alpha And Beta Of Investment Portfolio What Is Its Utility Getmoneyrich

Alpha Formula Calculator Examples With Excel Template

Understanding Differential Return Part 1 Vs Subtraction Alpha The Spaulding Group

Jensen S Measure Alpha Formula And Calculation

Jensen S Alpha Yadnya Investment Academy

What Is Alpha Robinhood

Alpha Formula Calculator Examples With Excel Template

Alpha And Beta Of Investment Portfolio What Is Its Utility Getmoneyrich

Alpha Formula Calculator Examples With Excel Template

Alpha Formula Calculator Examples With Excel Template

Alpha A Formula In Investments And Portfolio Management

Alpha A Formula In Investments And Portfolio Management

Alpha Formula Calculator Examples With Excel Template

Jensen S Alpha Yadnya Investment Academy